|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

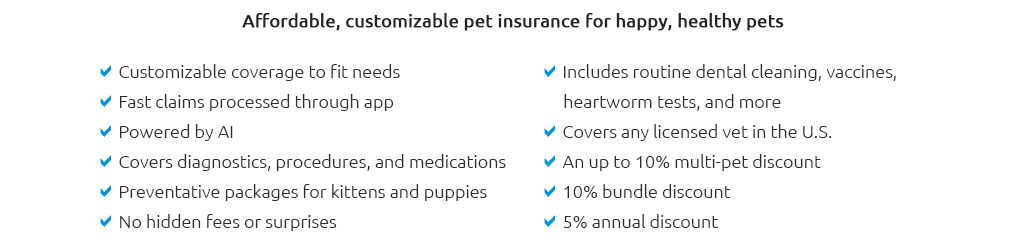

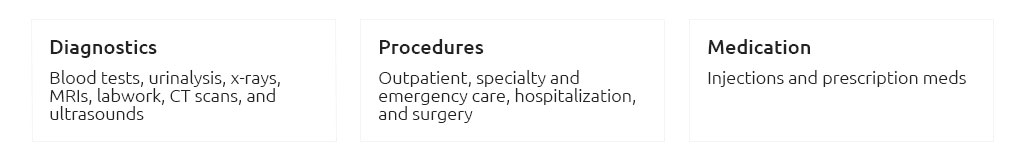

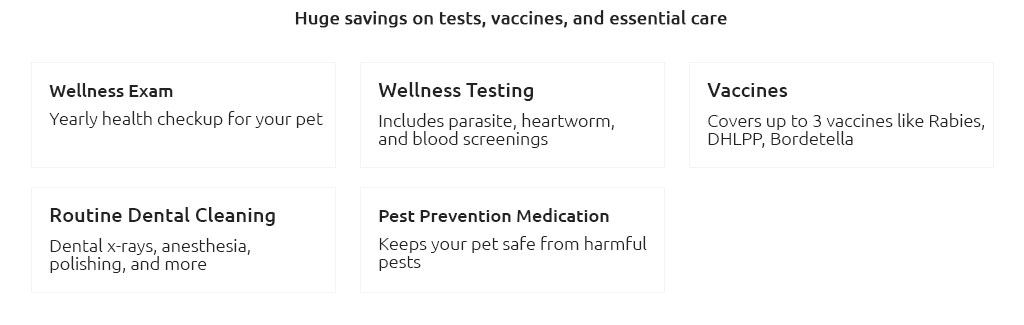

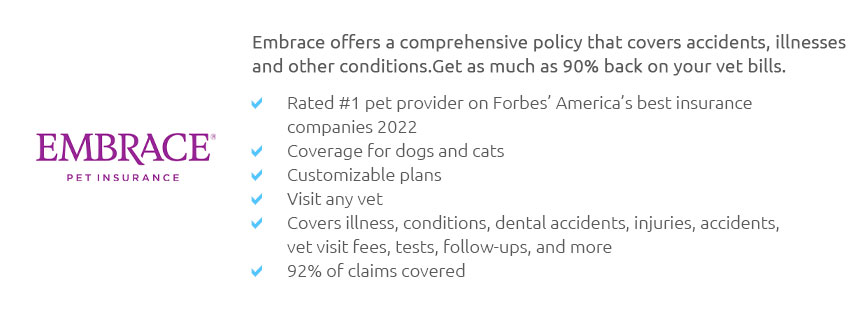

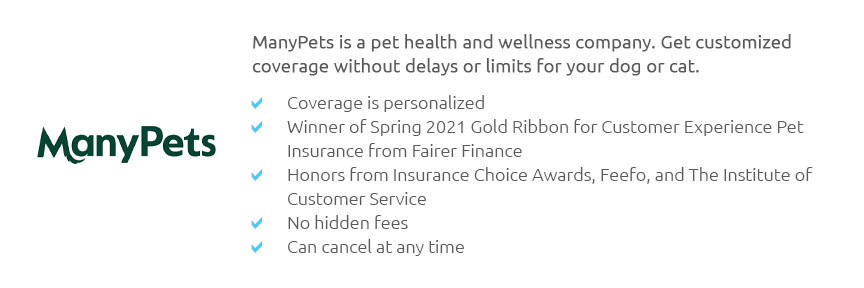

Pet Insurance Compared: Navigating the Maze of OptionsIn today's world, where pets are cherished family members, the question of pet insurance often arises, demanding a closer look at its value and nuances. This article delves into the myriad aspects of pet insurance, offering a comprehensive comparison that aims to demystify the choices available to conscientious pet owners. With a plethora of options, finding the right insurance can feel overwhelming, yet understanding key factors can illuminate the path. To begin with, it's essential to grasp the scope of coverage provided by different policies. Most insurance plans are designed to cover unexpected accidents and illnesses, but the breadth of coverage can vary significantly. Some policies include wellness visits and preventive care, while others focus solely on emergencies. A pet owner's decision should hinge on their specific needs and the health profile of their pet, as well as their financial situation.

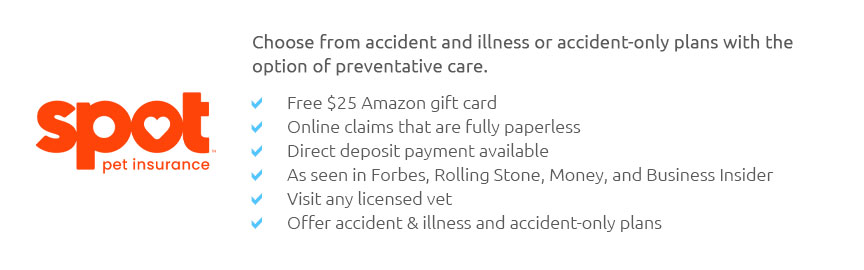

Furthermore, pet owners must consider the cost associated with insurance plans. Premiums are influenced by various factors, including the pet's age, breed, and pre-existing conditions. Young and healthy pets often attract lower premiums, but as pets age, costs may rise. Interestingly, breed-specific conditions can also affect pricing, with some breeds being predisposed to certain health issues, thus incurring higher costs. The reputation and reliability of the insurance provider is another pivotal consideration. It's wise to research customer reviews and ratings, assess the provider's financial stability, and understand their claims process. A company with a history of transparent, efficient claims handling and good customer service can make a significant difference in the experience of managing pet health expenses. In conclusion, while the labyrinth of pet insurance options may initially seem daunting, taking the time to compare plans based on coverage, cost, and provider reputation can lead to a well-informed decision. Each pet and owner is unique, and the ideal insurance plan should align with individual needs and financial realities. By considering these facets, pet owners can secure the well-being of their beloved companions, ensuring a worry-free journey through the unpredictable twists of life. Whether opting for a basic plan or a comprehensive package, the right choice empowers pet owners to focus on what truly matters: the joy and companionship that pets bring to our lives. https://spotpet.com/compare-pet-insurance

Dive into our comprehensive pet insurance comparison to see how Spot's offerings measure up against other providers. https://www.petinsurancequotes.com/compare/

You can compare the top pet insurers side-by-side by clicking on the links below. Each chart shows coverage options, customer ratings, and additional ... https://www.petinsurance.com/comparison/

With Nationwide pet insurance, you get 24/7 veterinary advice, low-cost prescriptions, discounts on pet products and more.

|